More flexibility with cuInsight

Central Liverpool’s old solution gave them provision data that was incorrect and couldn’t be changed. With cuInsight, Geoff could change the parameter to Central Liverpool’s provision rate.

cuInsight also helps Central Liverpool ensure their information is accurate and up-to-date. They can easily export member information and see, for example, those members who don’t have postcodes or a phone number entered.

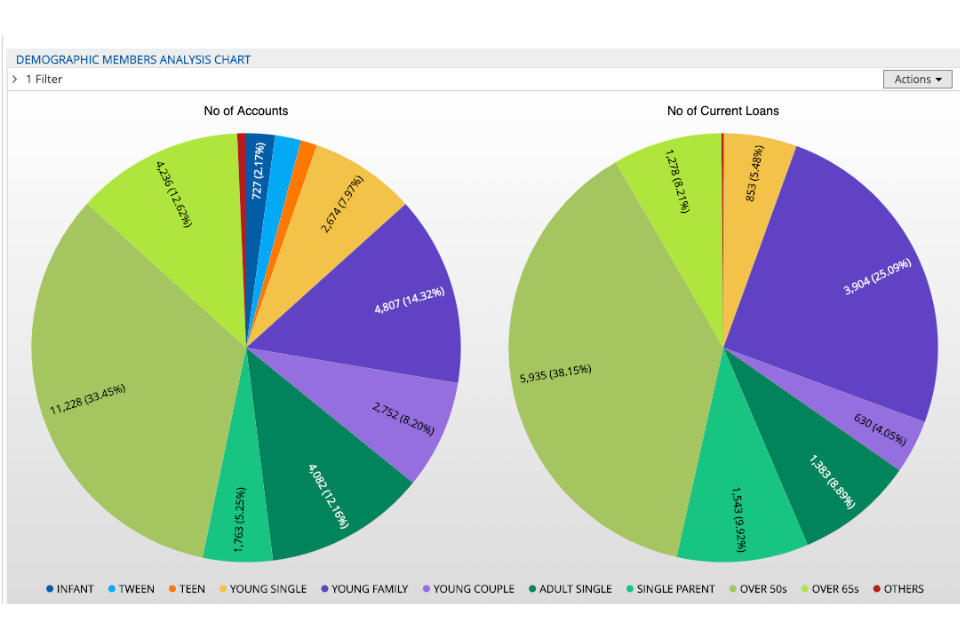

From member data, Central Liverpool can also use ‘codes’ to group like-minded accounts together, and report on area, age and whether they signed up online or in-branch. They can analyse any patterns and tweak their marketing efforts accordingly.